Exploring the Recent Surge of Quant (QNT) in a Bear Market

Written on

Chapter 1: Analyzing Quant's Performance

Have you noticed the impressive movement of Quant (QNT) since my last article on this cryptocurrency three weeks ago? Many analysts are optimistic about QNT's potential to climb to the $160 mark in the near future. However, as with all market predictions, these remain speculative.

In case you missed it, here's a link to my previous article on QNT:

What Sets Quant Apart

Quant (QNT) is an Ethereum-based token designed for its Overledger network, which aims to facilitate blockchain interoperability.

Here’s a glance at the QNT performance chart via Trading View:

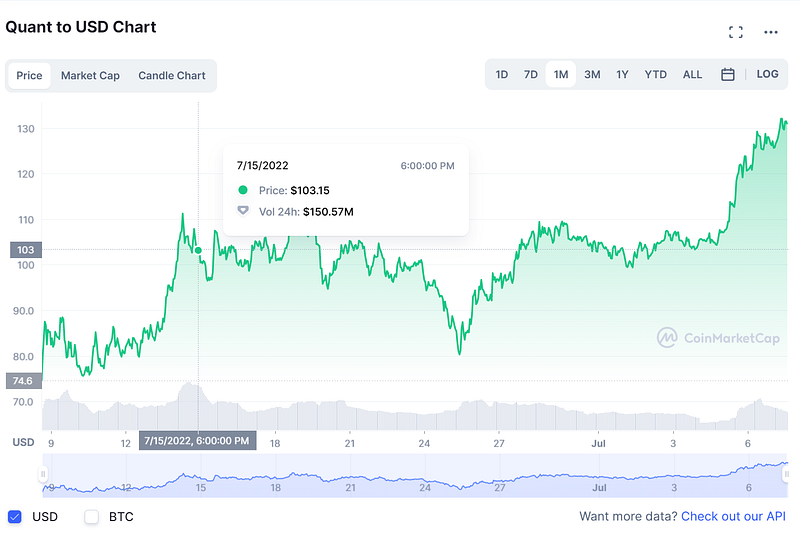

Additionally, here’s the Coin Market Cap QNT to USD chart from the last month:

According to Cointelegraph, Quant (QNT) has seen a significant rebound from a low of $40 on June 13. Despite bearish attempts to halt the upward trend at $115, bullish investors swiftly capitalized on dips below the 20-day EMA of $103 on July 26.

What distinguishes QNT is its capped supply of 14,612,493 tokens, which is about 6 million less than Bitcoin (BTC). While comparing the two may seem like comparing apples to oranges, this metric highlights QNT's scarcity in the cryptocurrency arena.

The maximum supply of a coin plays a crucial role in assessing its Total Value Locked (TVL), a metric akin to the price-to-earnings ratio in stock investments. According to The Motley Fool, “Total value locked (TVL) represents the aggregate of all assets deposited in decentralized finance (DeFi) protocols that earn rewards, interest, and new coins.”

Note: “Investments carry risks, including the potential loss of principal. Past performance does not guarantee future outcomes.” — TD Ameritrade. The term “security” can refer to stocks, cryptocurrency, gold, or any asset class.

Disclaimer: This article is intended for entertainment and informational purposes only and should not be viewed as financial or legal advice. Not all presented information may be accurate. I am not a financial advisor; please consult a professional before making significant financial decisions.

Join the conversation and stay informed by subscribing to DDIntel.

Chapter 2: Video Insights on Quant (QNT)

In the video titled "Would I Buy Quant (QNT) in the Bear Market? Installment 43 of 1001," the creator delves into the viability of investing in QNT during the current market conditions.

The second video, "QUANT Is About To SHOCK The Crypto World In 2024!" discusses expected trends and potential market impacts of QNT in the upcoming year.

About the Author

Stephen Dalton, a retired US Army First Sergeant, holds a journalism degree from the University of Maryland and is a Certified US English Chicago Manual of Style Editor. He has written extensively on various subjects, including nutrition, investing, and technology.

Website | Facebook | Twitter | Instagram | Reddit | Ko-fi | NewsBreak | Simily