Unlocking the Power of Fractional Differentiation in Trading

Written on

Chapter 1: Introduction to Fractional Differentiation

In algorithmic trading, gaining a competitive advantage is crucial. One effective method for enhancing trading strategies is by utilizing fractionally differentiated features in the analysis of financial data. These features allow traders to identify subtle patterns within the data, potentially leading to improved predictions and more informed trading choices.

Photo by Austin Distel on Unsplash

Let’s delve into the concept of fractionally differentiated features and explore how they can be applied to refine trading strategies.

Section 1.1: Acquiring Real Financial Data

To conduct our analysis, we first need to gather authentic financial data across a range of assets. We can utilize the yfinance library to obtain historical price data. Below is the code to import the necessary libraries and download the data:

import yfinance as yf

# Define a list of assets to download data for

assets = ['GOOG', 'TSLA', 'NFLX', 'BTC-USD', 'AAPL']

# Download historical price data for the assets

data = yf.download(assets, start='2020-01-01', end='2024-02-29')

Having secured the data, we can now move on to preprocessing it and applying fractionally differentiated features to bolster our trading signals.

Section 1.2: Data Preprocessing

Before we can apply fractionally differentiated features, it's essential to preprocess the data to ensure it's ready for analysis. This involves cleaning the data, addressing any missing values, and calculating returns for each asset. Here’s how we can preprocess the data:

import pandas as pd

# Clean the data and handle missing values

data = data['Adj Close'].dropna()

# Calculate daily returns for each asset

returns = data.pct_change().dropna()

With the data cleaned and prepped, we can now implement fractionally differentiated features to extract more valuable insights from the time series data.

Chapter 2: Implementing Fractionally Differentiated Features

Fractionally differentiated features enable us to modify the memory of a time series, allowing for the capture of long-term dependencies while reducing short-term noise. In this section, we’ll manually implement fractional differentiation with a parameter of 0.5:

import numpy as np

# Implement fractional differentiation manually with d=0.5

fd_returns = pd.DataFrame(index=returns.index)

for asset in assets:

price = returns[asset]

fd_price = np.cumsum(price)

fd_returns[asset] = fd_price

The fd_returns DataFrame now comprises the fractionally differentiated returns data, which can be utilized to enhance our trading signals.

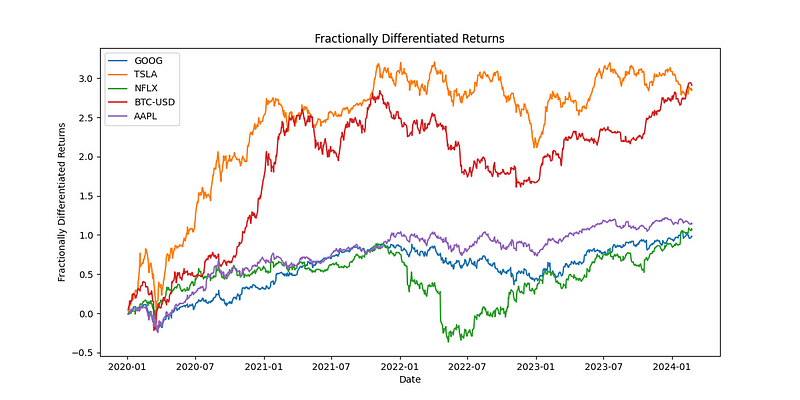

Section 2.1: Visualizing Fractionally Differentiated Features

Visualizing fractionally differentiated features can yield significant insights into the financial data's dynamics. We will plot the fractionally differentiated returns for each asset to observe any long-term dependencies that may exist:

import matplotlib.pyplot as plt

# Plot fractionally differentiated returns for each asset

plt.figure(figsize=(12, 6))

for asset in assets:

plt.plot(fd_returns[asset], label=asset)

plt.title('Fractionally Differentiated Returns')

plt.xlabel('Date')

plt.ylabel('Fractionally Differentiated Returns')

plt.legend()

Figure 1: Fractionally Differentiated Returns for Various Assets

The chart above illustrates the fractionally differentiated returns for the selected assets, revealing any long-term dependencies that may be present. By analyzing these features, traders can potentially uncover hidden patterns that inform their trading strategies.

Conclusion

In this tutorial, we examined the implementation of fractionally differentiated features for enhancing trading algorithms. By applying fractional differentiation to financial data, traders can identify nuanced patterns and increase the accuracy of their strategies.

We began by downloading real financial data using the yfinance library, followed by preprocessing the data, implementing fractionally differentiated features, and visualizing the results to gain insights into market dynamics. Utilizing these features in trading algorithms can empower traders to stay ahead and make informed decisions in the ever-evolving financial landscape.

Fractionally differentiated features are a powerful tool for improving trading strategies. By experimenting with different parameters and incorporating these features into your algorithms, you can gain a competitive edge.

Remember, successful trading hinges on continuous learning and adapting to market changes. Stay inquisitive, explore new techniques, and strive to enhance your trading strategies for enduring success in the financial markets.

The first video titled "Fractional Differentiation - Example | Financial Machine Learning Course" provides a detailed overview of fractional differentiation, illustrating its applications in financial contexts.

The second video titled "Fractional Differencing: More Insight, Less Work" offers further insights into fractional differencing, simplifying complex concepts for practical use.