Understanding the Current Cryptocurrency Crisis: A Clear Perspective

Written on

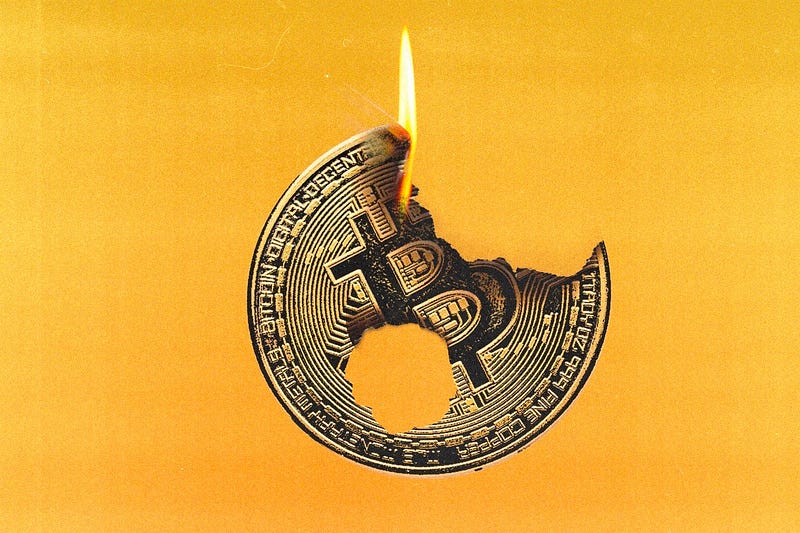

Chapter 1: The State of Cryptocurrency Today

Cryptocurrency is currently facing significant turmoil, prompting many to wonder what exactly is happening. Allow me to clarify without resorting to technical jargon.

Image credit-ElenaLacey/Getty

As someone who has immersed myself in the world of cryptocurrency since 2013, my perspective differs from the mainstream narrative. The dramatic downturns in 2018 and 2020 particularly influenced my outlook.

One recent incident involved UST, a stablecoin intended to mirror the US dollar, where 1 USD equaled 1 UST. It provided a seamless way for traders to liquidate their crypto holdings without leaving the crypto ecosystem. Unfortunately, UST was poorly designed. When savvy investors attempted to exploit its weaknesses, panic ensued, leading to a significant drop in its value.

Notably, major investment firms and renowned investors had stakes in Terra, the project behind UST. Personally, I also invested a small amount in Terra Luna, the platform supporting UST, which is now effectively worthless. Attempts to revive Terra with a Version 2 have also faltered. The collapse of a significant cryptocurrency is reminiscent of the Lehman Brothers' fall during the 2008 financial crisis, triggering further market instability.

Section 1.1: The Collapse of Crypto Savings Solutions

In traditional finance, US dollars yield minimal interest. Celsius, a company offering crypto savings accounts, allowed users to earn interest by locking up their crypto assets. Just as I completed a course discussing Celsius, the company froze all customer withdrawals due to its exposure to the Terra Luna collapse.

This incident exemplifies systemic risk in finance—when one entity falters, it can lead to a domino effect across the market. With Celsius now potentially defunct, we may witness further downturns in the crypto sector.

Subsection 1.1.1: Understanding the Nature of Crypto Investments

Cryptocurrencies often fail for compelling reasons. Outside of Bitcoin and Ethereum, many altcoins lack proven viability. The 2018 crash saw numerous coins lose most of their value, with many never recovering.

Investors typically fall into two categories:

- Dreamers: These individuals invest in new cryptocurrencies, hoping they will become the next major disruptors, often ignoring market relevance.

- The OGs (Original Gangsters): They prioritize investments that demonstrate cash flow, network adoption, and the credibility of the development team. Their main focus tends to be on established currencies like Bitcoin and Ethereum.

Section 1.2: The Impact of Global Events on Financial Markets

Historically, global events significantly influence financial markets over time. For instance, the September 11 attacks in 2001 were a precursor to the 2008 recession. The COVID-19 pandemic similarly caused a market collapse, but quick recovery followed due to an unprecedented influx of US dollars into the economy.

The ramifications of such crises can take years to unfold. Many investors became complacent, not realizing that 40% of US dollars were printed to mitigate the pandemic's economic impact. The eventual consequences of these actions are now beginning to manifest.

Chapter 2: The Ripple Effects of Economic Policy

As the government gradually reduces the money supply that fueled recent economic growth, we face rising interest rates—an unsustainable situation.

The Bitcoin Spiral! (THIS IS EXTREMELY IMPORTANT) - YouTube This video explores the crucial dynamics affecting Bitcoin and its market trajectory.

The increase in interest rates raises borrowing costs, which historically leads to declining asset prices. While many anticipate continuous rate hikes, I predict the strategy will falter, especially as mid-term elections approach and economic conditions worsen.

Crypto's fate is intertwined with the overall economic landscape. A downturn in the stock market typically spells trouble for cryptocurrencies. If monetary policy shifts back to increasing the money supply and lowering interest rates, we could witness a resurgence in crypto markets. Conversely, a prolonged recession will continue to challenge the crypto landscape.

What the Hell is Cryptocurrency anyway? | Main Street Business - YouTube This video demystifies cryptocurrency, explaining its implications for the broader economy.

Section 2.1: The Current Economic Challenges

Currently, inflation in the US is soaring at 8.6%, causing substantial increases in living expenses. As disposable income dwindles, fewer individuals have funds to invest in cryptocurrencies. Concurrently, institutions that began investing in crypto are withdrawing their capital as risk aversion rises.

For those with experience in finance, these shifts are not surprising; they are simply part of the cyclical nature of the market.

What I’m Doing During the Chaos

In these turbulent times, I would typically be aggressively purchasing Bitcoin and Ethereum. However, I must first address an upcoming tax obligation. Once that's settled, I plan to implement a Dollar-Cost Averaging strategy, investing consistent amounts each month regardless of market fluctuations.

I will continue to: - Engage with smaller cryptocurrencies for enjoyment - Stay updated with insights from crypto experts - Participate in the vibrant crypto culture - Share knowledge with those eager to learn - Ignore naysayers who fail to recognize the technological advancements inherent in Bitcoin and Ethereum

What You Can Do

Given the likelihood of a recession: - Avoid investing money you can’t afford to lose in cryptocurrencies. - Maintain cash reserves to capitalize on potential market dips. - Be cautious of debt and refrain from participating in schemes like buy now, pay later. - Practice kindness amidst the chaos, as conditions may worsen before they improve. Remember, after every harsh winter in the market, spring will eventually arrive.

Closing Thought

Heed the advice of optimists rather than doomsayers to navigate these challenging times effectively. Curate your information sources carefully to avoid falling prey to sensationalist narratives. The next phase of growth in the cryptocurrency market promises to be incredibly exciting. Stay vigilant.

This article is intended solely for informational purposes and should not be viewed as financial, tax, or legal advice. Always consult with a financial professional before making significant investment decisions.

Join my email list, where over 50,000 subscribers receive valuable financial insights.