Exploring Cardano: A Comprehensive Overview for Beginners

Written on

Introduction to Cardano

Cardano is recognized as a "third-generation" proof-of-stake blockchain platform, with aspirations to challenge Ethereum's status as the primary blockchain infrastructure.

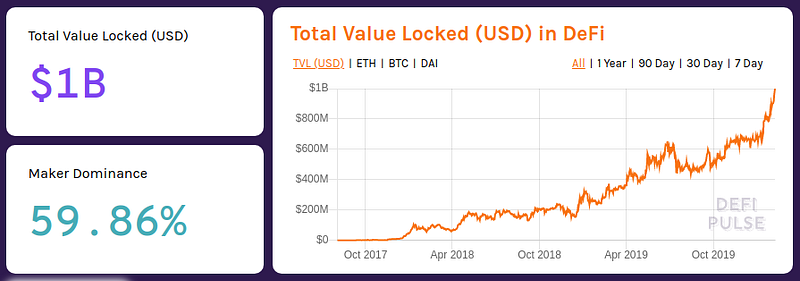

Since mid-2020, decentralized finance (DeFi) assets have seen remarkable growth, largely influenced by the Bitcoin bull market. By early February, DeFi projects achieved a significant milestone, surpassing $1 billion in Total Value Locked (TVL). As most DeFi initiatives are built on Ethereum’s infrastructure, the platform has further solidified its position as the leading blockchain provider. However, increasing network congestion and high transaction fees have raised concerns about Ethereum's scalability.

Source: DeFi Pulse Cardano aims to tackle the scalability and performance issues that have plagued older blockchain platforms such as Bitcoin and Ethereum. While often dubbed an "Ethereum Killer," it is essential to delve into its technology and future plans before assessing its potential to surpass Ethereum.

What is Cardano?

Founded in 2015 by Charles Hoskinson, a co-founder of Ethereum, Cardano is a blockchain platform distinguished by its commitment to transparent research and evidence-based development. It holds the title of the first blockchain project to undergo peer review.

The name "Cardano" pays tribute to the Italian mathematician Gerolamo Cardano, while its native currency, ADA, is named after Ada Lovelace, widely regarded as one of the first computer programmers. Similar to Ether, ADA serves both as a digital currency and a means of transaction within the Cardano ecosystem. Approximately 57.6% of the maximum supply of 45 billion ADA was distributed during the 2017 Initial Coin Offering (ICO).

Cardano's development is managed by three organizations: - Cardano Foundation: Oversees the project, focusing on partnerships and the legal framework surrounding the Cardano brand. - IOHK: Responsible for the blockchain's technical development. - Emurgo: Promotes Cardano's adoption and supports the developer community in creating solutions.

Cardano's Architecture

Hoskinson describes Cardano as a third-generation blockchain, following Bitcoin and Ethereum, which represent the first and second generations, respectively. Bitcoin validated the concept of decentralized transaction validation, while Ethereum introduced smart contracts that execute transactions when specific conditions are met.

Despite the institutional recognition of Bitcoin as digital gold and the ongoing rise of DeFi applications, these earlier blockchains face significant challenges, including scalability, interoperability, and sustainability.

- Scalability: Bitcoin and Ethereum can only handle 5-15 transactions per second (TPS), as each participating node must validate every transaction to achieve consensus. This limitation restricts network scalability through resource addition, and as the blockchain grows, old data must be pruned.

- Interoperability: Although wrapped Bitcoin and oracles exist to connect disparate blockchain networks, the bridge between blockchain and traditional finance remains fragile. Centralized exchanges like Coinbase facilitate this connection, but it is not seamless.

- Sustainability: Governance models in blockchain projects are often flawed, leading to hard forks (e.g., Ethereum Classic, Bitcoin Cash), which exacerbate interoperability issues. Many projects also struggle to find sustainable growth paths beyond initial funding events.

Cardano seeks to address these challenges by implementing a layered blockchain architecture, consisting of the Cardano Settlement Layer (CSL) for transactions and the Cardano Computational Layer (CCL) for smart contracts. This separation contrasts with Ethereum's model, which combines both functions.

Cardano utilizes the Ouroboros consensus protocol based on proof-of-stake, allowing a select group of nodes, known as slot leaders, to validate transactions instead of requiring all nodes to do so. Slot leaders are chosen randomly from staking pools based on their holdings, and they earn ADA tokens as rewards for their validation work. Additionally, part of the block rewards is allocated to the Cardano treasury to fund ecosystem-enhancing projects.

The recent introduction of Ouroboros Hydra has added sharding capabilities to the proof-of-stake system, reportedly achieving 1,000 TPS—an increase from 257 TPS observed in 2017 trials. Cardano also supports KMZ sidechains to facilitate fund movement between CSL, CCL, and other compatible blockchains. The platform's hard fork combinator enables seamless transitions between hard forks, exemplified by the smooth upgrade from the Byron model to the decentralized Shelley model in 2020.

For a deeper understanding of Cardano's vision and architecture, check out this insightful video from Charles Hoskinson:

Cardano's Roadmap

Cardano's development is structured into five distinct eras: Byron, Shelley, Goguen, Basho, and Voltaire. As of early 2021, Cardano was in the Shelley phase, with the Goguen mainnet rollout anticipated in March 2021.

- Byron: Launched in September 2017, this era laid the foundational elements of Cardano, implementing the federated Ouroboros consensus protocol and enabling ADA token transfers, along with specific wallets for token storage (Daedalus, Yorroi).

- Shelley: Commencing in July 2020, the Shelley hard fork initiated staking rewards and transitioned the network from a federated to a decentralized model.

- Goguen: This update will integrate smart contracts into Cardano, fostering a robust developer community and promoting DApp development through the Marlowe language. Interoperability with existing smart contracts in other programming languages is also expected.

- Basho: This era focuses on optimizing network scalability, proposing features like sidechains for enhanced interoperability.

- Voltaire: The final phase aims to enhance sustainability through voting and treasury systems.

Review of Cardano

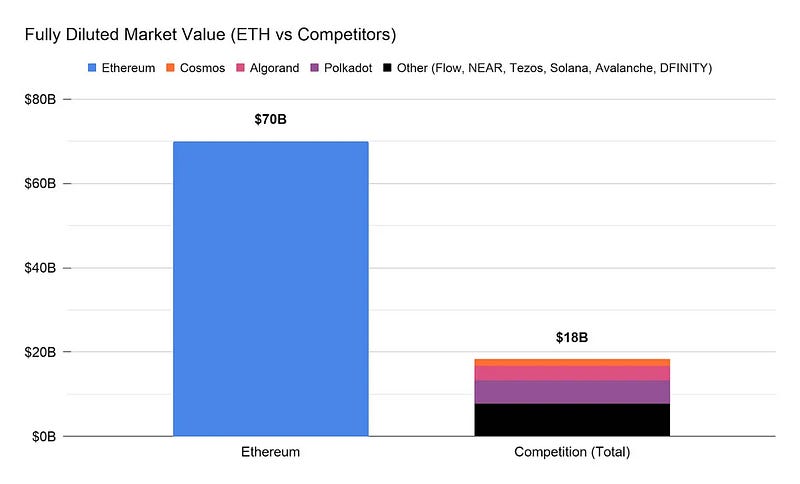

By emphasizing rigorous research, Cardano has opted for a gradual rollout approach. Proponents believe this strategy provides a competitive edge by allowing extensive testing before large-scale deployment. Critics, however, highlight Ethereum's growing dominance in the DeFi sector. Current market analysis shows Ethereum maintains a substantial lead over competing projects, including those labeled as "Ethereum killers." Despite Cardano's lack of smart contract support at this time, it consistently ranks among the top six projects by total market capitalization.

Source: Coinbase The pivotal question remains whether Cardano's advanced technology can surpass Ethereum's first-mover advantage and the extensive infrastructure, community support, and funding it has accumulated. Historically, superior technology alone has not guaranteed market success, and it will be interesting to observe how the rollout of Ethereum 2.0 and Cardano's growth impact developer and user migration amid high transaction fees and network congestion on Ethereum.

Disclaimer: This article is not intended as investment or financial advice. All opinions expressed are solely those of the author.