Enhancing Our Competitive Edge in Deep Tech Investments

Written on

Chapter 1: The Importance of Deep Tech

In recent weeks, alongside critical discussions surrounding Covid-19, social protests, and systemic racism, several legislative initiatives have emerged that could significantly benefit Deep Tech investing. These initiatives address the persistent underfunding of fundamental research in crucial technology sectors and highlight the need for more efficient research markets. Notably, one bill targets our lack of investment in essential technical domains that bolster national competitiveness, while another focuses on stimulating innovation in regions beyond the traditional tech hubs of the Bay Area, New York, and Boston. Both developments are vital as we strive to create opportunities for all communities across America.

Section 1.1: Scientific Research as a Pillar of Competitiveness

There is a growing recognition that the United States has not invested sufficiently in key technological areas critical for future advancement. The recent tensions between the U.S. and China have underscored this reality, particularly in sectors where we rely on China for essential technologies. With China's substantial investments in emerging tech, concerns about falling behind have become increasingly prevalent.

To fortify the United States' status as a global technology leader, a bipartisan coalition of senators has proposed the Endless Frontier Act. This legislation aims to revamp the National Science Foundation (NSF) to enhance the nation’s leadership in scientific and technological innovation through increased funding for the discovery, creation, and commercialization of future technology fields.

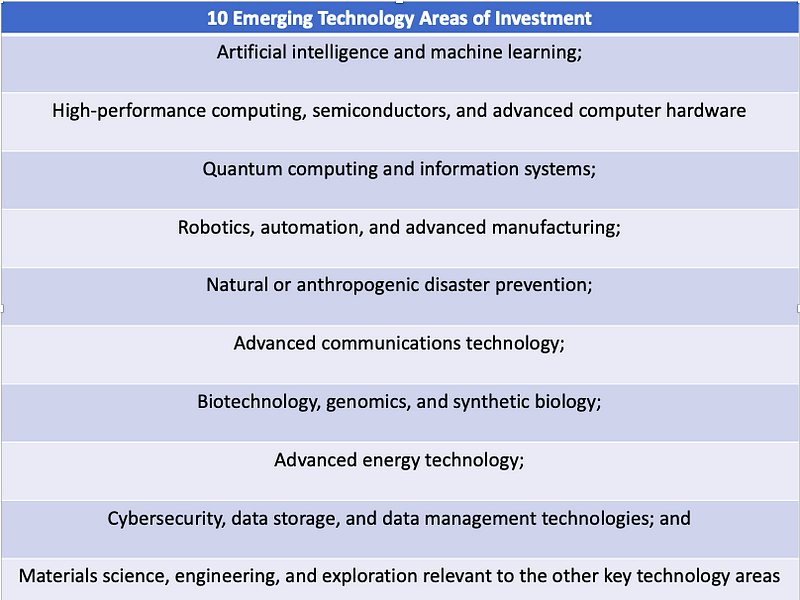

The Technology Directorate is set to receive $100 billion over the next five years, focusing on ten key areas:

These focus areas align with the interests of Deep Tech investors, who are actively seeking opportunities in these sectors. To ensure ongoing avenues for exploration, basic scientific research must also receive funding, as venture capital typically avoids investing at such an early stage.

An exciting aspect of this bipartisan initiative includes the allocation of an additional $10 billion to establish at least ten regional technology hubs. These hubs aim to provide funding for investment initiatives that position various regions as global centers for research, development, and manufacturing of critical technologies. This approach seeks to diversify opportunities beyond traditional tech regions and tap into a wider range of technical talent nationwide.

Section 1.2: Empowering Communities and Local Economies

Around the same time, just a week prior to the Science and Technology proposal, Senator Amy Klobuchar (D-MN) introduced the New Business Preservation Act. Alongside Senators Chris Coons (D-DE), Angus King (I-ME), and Tim Kaine (D-VA), this bill proposes a one-to-one government match for investments in promising, scalable startups located outside the typical venture capital hotspots. This concept mirrors opportunity zones, with the aim of channeling capital into underserved areas of the country. Approximately 80% of the funding is targeted for the Midwest, Southeast, and Southwest regions. Profits from successful exits would be reinvested into the next wave of new businesses, fostering a sustainable funding cycle. Allocations would be based on population, adjusting figures for states like California, New York, and Massachusetts to account for existing VC concentrations.

The proposal sets aside $2 billion, with investments divided into two phases. $1.5 billion would be allocated for initial rounds, while $500 million would support follow-up investments in successful companies.

This initiative does not involve the federal government arbitrarily selecting winners and losers. The New Business Preservation Act draws inspiration from Israel's Yozma program, initiated in the late '90s following the influx of Russian Jewish immigrants, many of whom were skilled scientists and engineers who started businesses. At that time, about 98% of venture capital was raised and invested in the United States. The Yozma program aimed to attract venture capitalists to explore innovation in Israel by incentivizing them with a one-to-one match of Israeli government dollars for private VC contributions. This initiative has been pivotal in cultivating the vibrant Israeli startup ecosystem.

By providing matching government funds contingent upon prior private investments, the Yozma program preserved the benefits of private capital while enhancing it with government support. The New Business Preservation Act seeks to replicate this model. Additionally, the U.S. Air Force is exploring a similar strategy, using Small Business Investment Research funds to match private capital for technology ventures of interest.

In summary, I am optimistic about these developments! Continuous investment is crucial for maintaining innovation and, more importantly, creating future opportunities. We must adopt a more strategic approach to ensure that opportunities are equitably distributed across all communities.

I look forward to monitoring the progress of this legislation and exploring ways to level the playing field, ensuring that all individuals have access to the funding and opportunities they generate.