Debunking Myths from “The Bit Short: Inside Crypto’s Doomsday Machine”

Written on

Chapter 1: Understanding the Bitcoin Market

As seasoned Bitcoin enthusiasts, we remain unfazed by the persistent misconceptions surrounding the Bitcoin market. Unlike traditional markets, the Bitcoin arena is inundated with misinformation—ranging from price valuations to use cases, and skepticism surrounding data. This noise makes it challenging for newcomers to discern the genuine signals.

Recently, a misleading article titled “The Bit Short: Inside Crypto’s Doomsday Machine” has resurfaced, perpetuating confusion. The author has fallen into common traps concerning Bitcoin exchange data, the perception of Bitcoin as a tool for black market transactions, and the associated fears surrounding Tether—a notable grey market dollar solution.

This piece will dissect the author's primary claims, highlighting the misunderstandings that underpin them and demonstrating why such notions should not influence anyone's views on Tether or its connection to Bitcoin.

Section 1.1: The Tether Conspiracy Theory

At the heart of the Tether conspiracy lies the assumption that the Bitcoin market lacks legitimacy and that any demand for Bitcoin is merely driven by FOMO arising from "fraudulent Tether printing." This narrative, while prevalent in 2016 and 2017, has significantly weakened over time. In 2021, as fiat currencies face substantial devaluation, both individuals and institutions are increasingly turning to assets that deviate from fiat norms, with prominent investors openly discussing their Bitcoin allocations.

Despite the claims made in “The Bit Short,” the article largely relies on misinterpretations of data visualizations grounded in inaccurate information. Consequently, the assertions presented in this article are primarily unfounded FUD (fear, uncertainty, and doubt).

The author relies on discredited sources that have perpetuated the Tether narrative for over four years. Our aim here is not to defend Tether or its associated entities, but to clarify misconceptions stemming from “The Bit Short” and to equip new investors with the knowledge to navigate this complex landscape.

Section 1.2: A Brief History of Tether

Tether, introduced in 2014, is the original stablecoin, emerging nearly four years ahead of its competitors. Its significant adoption in 2017 prompted the launch of regulated alternatives like USDC, GUSD, and Paxos.

- October 2014: Tether (USDT) launched

- December 2017: Dai Stablecoin launched

- September 2018: USDC, GUSD, and Paxos launched

Tether remains the largest stablecoin by market cap and usage because it established the market and developed substantial network effects long before competitors arrived. While it certainly has its weaknesses, understanding Tether's role is crucial. It serves as a mechanism for bypassing traditional banking systems, which inherently raises regulatory concerns. Users often prefer Tether to convert Bitcoin into a “dollar” without involving banks. Essentially, Tether facilitates future Bitcoin buying demand and operates in a nuanced position within the broader Bitcoin ecosystem.

Chapter 2: Analyzing Key Arguments in “The Bit Short”

The author of “The Bit Short” presents several claims that warrant scrutiny.

Section 2.1: Debunking the $10 Billion Inflow Claim

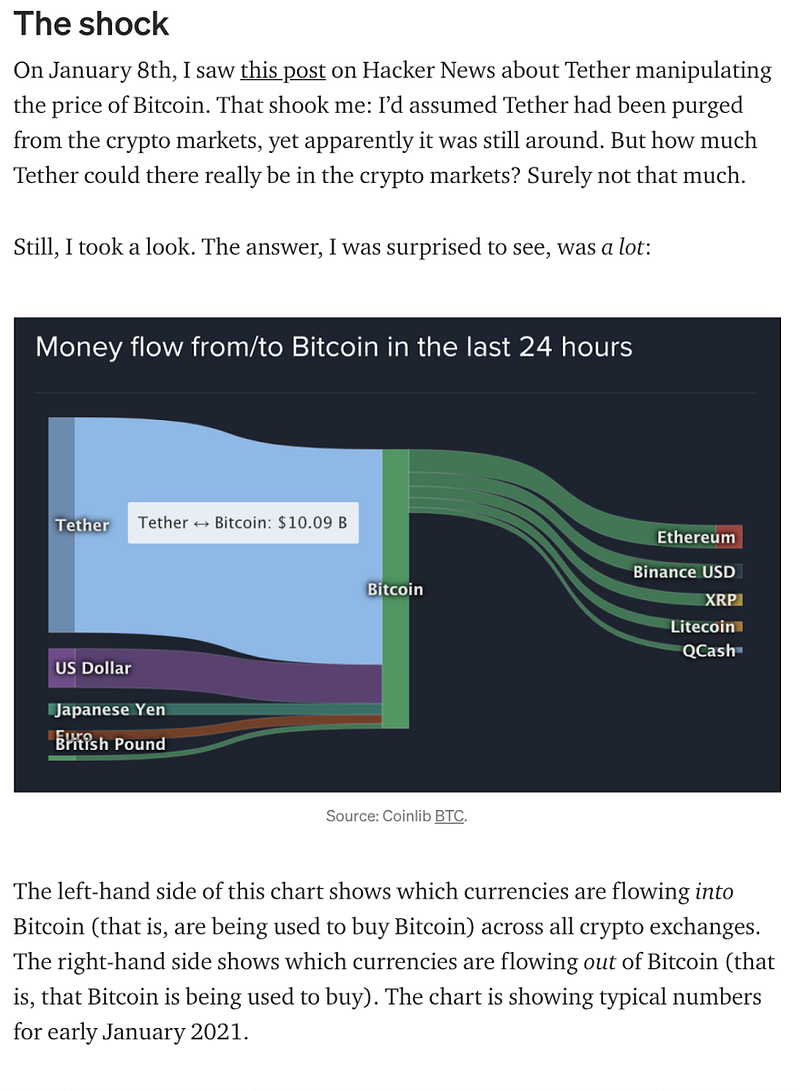

The first claim revolves around the assertion that Tether accounts for more than $10 billion in daily inflows to Bitcoin. However, the chart referenced actually illustrates volume, not one-way inflows, signifying a fundamental misunderstanding by the author.

The misrepresentation undermines the argument since it conflates trading volume with actual dollar inflows. In reality, the reported volume of Tether is around $10 billion but does not represent direct inflows into Bitcoin.

Section 2.2: Questioning the 70% Trading Volume Claim

The article also claims that Tether constitutes 70% of Bitcoin’s trading volume. To analyze this, we performed calculations based on data from various sources and found that Tether's contribution to Bitcoin's trading volume is closer to 66%, not 70%.

Additionally, the credibility of the data source cited by the author, coinlib.io, is questionable, as many exchanges are known for reporting inflated volumes to enhance their visibility on crypto data platforms.

Section 2.3: Addressing the Fraudulent Issuance Claim

The claim that Tether’s issuance processes must be fraudulent lacks a solid foundation. Tether Limited issues tokens to partners, and while the model differs from USDC, it does not imply illegitimacy. The growth of stablecoin market caps across various issuers suggests legitimate demand for Tether.

Section 2.4: Concluding Thoughts on Bitcoin and Tether

The Bitcoin community is well aware of Tether’s implications. Numerous experts have addressed the concerns surrounding Tether over the years, emphasizing the need for a balanced understanding of its role in the market.

... (additional sections can be added similarly to continue the analysis)