Exploring Bitcoin Ownership Trends Among UK Residents

Written on

Chapter 1: Bitcoin's Rising Popularity

Recent research indicates a notable increase in Bitcoin ownership among UK residents, with close to 16% now holding the cryptocurrency. This study, commissioned by Luno—a platform dedicated to buying, saving, and managing digital currencies—highlights the growing interest in Bitcoin.

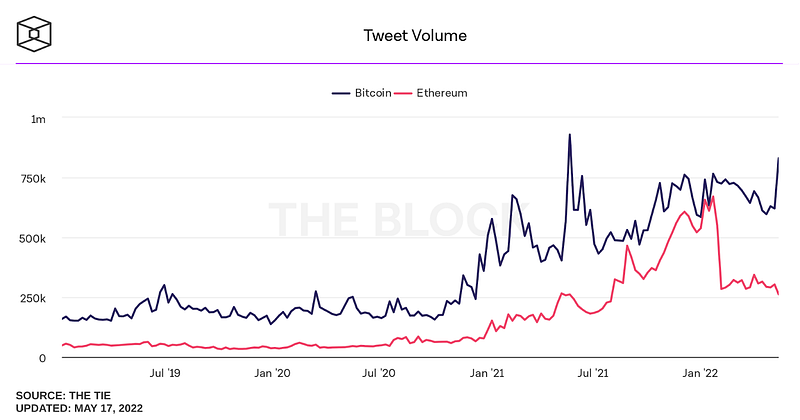

The findings show that Bitcoin's global popularity is on the rise, with discussions around the cryptocurrency surging on platforms like Twitter, according to data compiled by The Block.

Nations such as El Salvador and the Central African Republic have officially embraced Bitcoin as legal tender, further solidifying its presence in the financial landscape. Business news outlets frequently cover Bitcoin, indicating its substantial role in the economy.

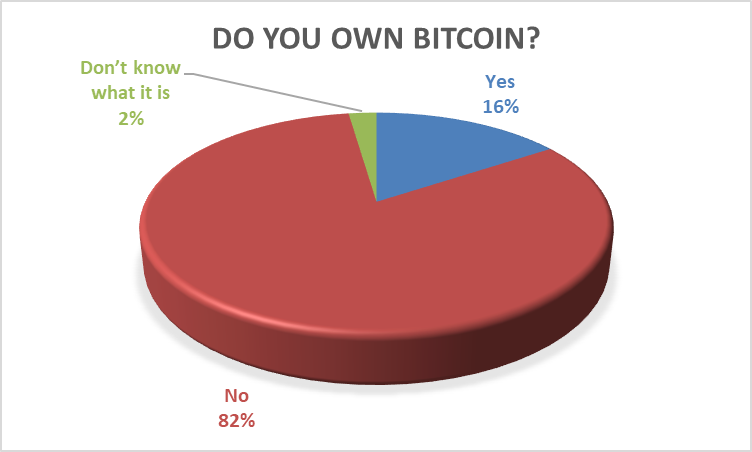

Many individuals ponder whether it is too late to invest in Bitcoin. However, a recent survey by 3Gem suggests that we may still be at an early stage in its adoption. This U.K.-based analytics firm collaborated with Quantum Economics to survey 1,000 individuals across the country regarding their Bitcoin ownership.

The respondents included a diverse age range, with an average age of 46, spanning various regions in England, as well as Scotland, Wales, and Northern Ireland. Notably, over half (51%) of the participants were women.

It’s important to recognize that the U.K. ranks as the sixth-largest economy globally, as reported by the International Monetary Fund (IMF).

Section 1.1: Understanding Bitcoin

Bitcoin is the leading cryptocurrency by market capitalization, functioning through a decentralized peer-to-peer network that facilitates trustless transactions. Created by an anonymous entity known as Satoshi Nakamoto, Bitcoin was launched in 2009 and is distinguished by several unique characteristics that differentiate it from traditional fiat currencies.

Bitcoin operates on a decentralized network, ensuring it cannot be manipulated by governmental or central bank interventions. New bitcoins are generated through a process termed mining, where network participants (miners) validate transactions. These transactions are stored in an immutable and transparent ledger known as blockchain, which is composed of sequential blocks once confirmed by the network.

Miners are rewarded with newly created bitcoins for their contributions, and the inflation rate of Bitcoin decreases approximately every four years. The upcoming halving event is projected for early 2024, at which point the rate of new bitcoins produced will be halved.

Currently, over 19 million bitcoins have been mined, with the total supply capped at 21 million. The last bitcoin is expected to be mined around 2140.

Section 1.2: Survey Results on Bitcoin Ownership

The 3Gem poll yielded some insightful results. A significant 82% of respondents reported not owning any Bitcoin, while 15.7% confirmed their ownership. Only 2.3% stated they were unfamiliar with Bitcoin.

Key takeaways from this survey include:

- A substantial portion of the public is now aware of Bitcoin.

- Ownership remains relatively low, though increasing.

Source: 3Gem

Conclusion

The increasing familiarity with Bitcoin among the populace reflects its growing prominence in both social and mainstream media. An impressive 98% of survey respondents in the U.K. recognized Bitcoin. Knowledge is a precursor to adoption, and with only 15.7% currently owning Bitcoin, there remains significant potential for growth.

As public awareness continues to expand through various channels, it is expected that more individuals will begin investing in Bitcoin. Thus, it appears we are still in the early stages of Bitcoin's adoption journey.

The first video titled British Hodl | One Bitcoin is Enough | Simply Bitcoin IRL explores the arguments for investing in Bitcoin, emphasizing its potential value and accessibility.

The second video, UK's Huge Crypto Crackdown – Major Changes Coming!, discusses the regulatory changes affecting cryptocurrency in the UK and their implications for investors.

This content is intended for educational purposes only and should not be considered investment advice. Always invest responsibly and only what you can afford to lose. The author of this article may hold assets mentioned herein.

If you found this information insightful and are interested in commissioning similar content, explore Quantum Economics’ Analysis on Demand service.